tax on unrealized gains india

Also the reinvestments would be of the entire earnings and not just post tax earnings in case of fixed deposits. Some billionaires pay no tax at all.

Capital Gains Tax In India An Explainer India Briefing News

Under the proposal taxpayers who are classified as illiquid may choose to include only unrealized gain in tradeable assets in the calculation of their respective minimum tax.

. The capitalization under the Income tax Act is solely governed by the provisions of Section 43A of the Income tax Act 1961. Bidens proposal would take the. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

Tax Implications of Unrealized Gains and Losses. Capital gains that come under special tax rates are. Under Bidens plan households worth more than 100 million who do not already pay 20 tax on their so-called full income would be subject to the additional tax.

But theres a catch here according to Chandrasekera. Its a big idea thats getting even bigger pushback. Legal obstacles loom for.

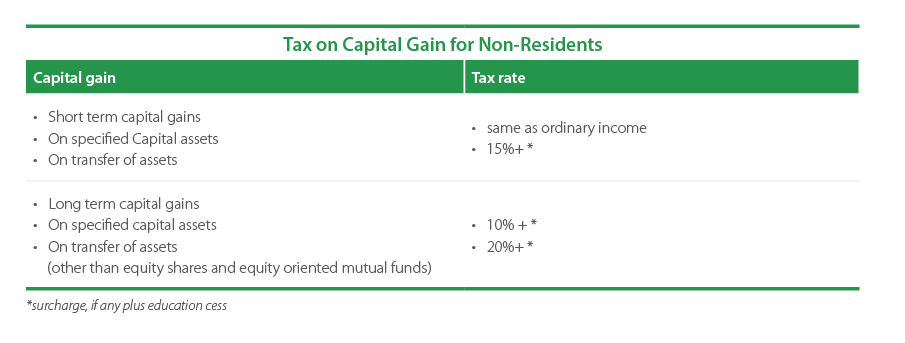

1 day agoToday On Point. 1 day agoSome billionaires pay no tax at all. Double taxation of foreign income for residents is avoided through treaties that generally provide for the deduction of the lower of foreign tax or Indian tax on the doubly taxed income from tax payable in India.

Paying for spending plans. As a result this new minimum tax will eliminate the ability for the unrealized income of ultra-high-net-worth households to go untaxed for decades or generations the document reads. For example if you were ahead of the curve and bought bitcoin for 100 and now its.

So effectively the tax she has to pay is less than what she had to pay for her fixed deposits. And then there are tax rates. The top 1 paid an average individual rate of 254 which is more than seven times the rate the bottom 50 paid according to the Tax Foundation.

Wealth taxation and the Biden administration targeting unrealized gains. And those already paying a tax rate of at least 20 on their total income including unrealized appreciation would not be affected. Tax saving us 80C to 80U is not allowed to Capital gains.

Tax Breaks under section 80c to 80U is not available to Capital gain Income. The tax officer has been empowered to pass an order granting consequential relief. The proposal would require wealthy households to remit taxes on unrealized capital gains from assets such as stocks bonds or privately held companies.

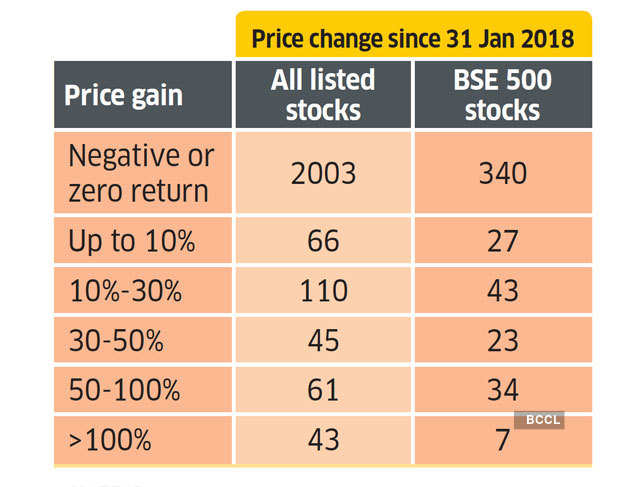

Gains exceeding INR 100000 made on sale of listed equities of an Indian company units of an Indian equity oriented fund and units of an Indian business trust would now be. India had exempted taxation of LTCGs since 2004 to attract investment in Indian equities provided that Securities Transaction Tax STT had been paid on acquisition of the shareholding. That was clearly a wealth tax with the tax 2 of the amount of taxpayers assets exceeding 50 million.

Senate Finance Chair Ron Wyden wants to tax billionaires unrealized wealth gains annually. This has been made effective from FY 201819 onwards. This week President Biden introduced a new tax proposal as part of the White House fiscal year 2023 budget to raise taxes on households with net wealth over 100 million.

The administration projects that more than half of revenues for the new payment would come from the nations roughly 700 billionaires. This means you dont have to report them on your annual tax return. Such taxpayers would be allowed to pay the 20 tax only on unrealized gains applicable to tradable assets including crypto.

The Democrats plan to tax billionaires unrealized capital gains has a problem. Bloomberg --President Joe Bidens plan to tax unrealized capital gains ran into opposition from key Democratic Senator Joe Manchin likely dooming it just hours after it was sent to Congress. Guests Steve Rosenthal senior fellow in the Urban-Brookings Tax.

Tax - Nil No sale Reinvestment of gains INR 80000 After 3 years. As per section 451 of the Income tax Act 1961 any profits or gains arising from the transfer of a Capital Asset effected in the previous year shall be chargeable to income tax under the head -Capital gains and shall be deemed to be the income of. If theres no sale theres no cash to pay the tax typically says Steve Rosenthal senior fellow.

Unrealized gains are not taxed by the IRS. The Unrealized Exchange Gainloss arisen on account of any capital asset covered under Section 43A of the Act is not allowed to be added in case of loss or taxed in case of gain since Section 43A treats the same on. Theres been a lot of debate this week over President Biden s latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires.

Then it was supposed to go up to. Gains INR 80000. Biden said he supports the proposal as a potential method.

So President Biden is proposing taxing the unrealized gains of the richest Americans taxing assets. The proposal under consideration from Senate Finance Committee Chairman Ron Wyden D Ore would impose an annual tax on unrealized capital gains on liquid assets held by billionaires Treasury. It will likely be challenged in court as unconstitutional.

If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF Insurance Policies or even ELSS kind of products. For tradable assets like stocks those above the income thresholds would have to pay an annual tax on the gain in the value of the asset they hold starting in 2022 using the mark-to-market method. Capital gains are only taxed if.

So President Biden is proposing taxing the unrealized gains of the richest Americans taxing assets the wealthy havent yet cashed out on. Amount invested - INR 1000000. The budget proposes that households worth more than 100 million pay at least 20 in taxes on both income and unrealized gains-- the increase in an unsold investments value.

Bidens fiscal 2023 budget request released Monday would impose a 20 minimum tax on the unrealized capital gains for households worth at least 100 million.

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

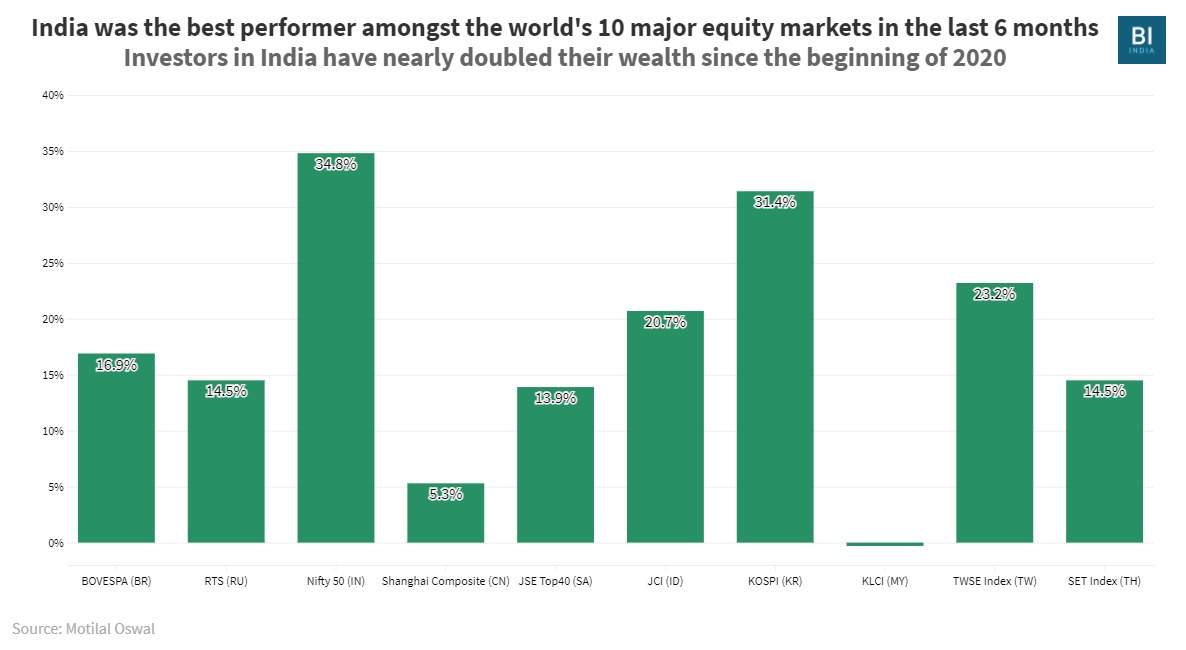

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Strategies For Investments With Big Embedded Capital Gains

The Unintended Consequences Of Taxing Unrealized Capital Gains

What Is Capital Gain Tax Of Capital Gains In India Fincash

Strategies For Investments With Big Embedded Capital Gains

How Are The Gains From Foreign Stocks Taxed In India Quora

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

How Do Short Term Capital Gains Work Vs Long Term Capital Gains Quora

Unintended Consequences Of Taxing Unrealized Capital Gains Investing Com

What Is Capital Gains Tax Quora

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Capital Gains Definition 2021 Tax Rates And Examples

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

Ltcg Tax On Equity Here S A Trick To Lower Your Tax On Capital Gains From Equity